kern county property tax search

California Kern County 1655 Chester Ave Bakersfield CA 93301 Number. Property Taxes - Assistance Programs.

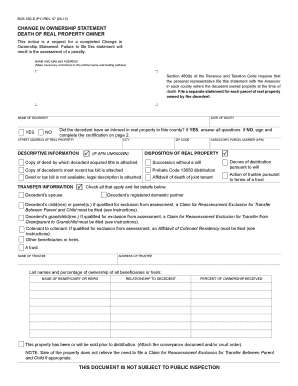

Kern County Pcor Fill Online Printable Fillable Blank Pdffiller

1115 Truxtun Avenue Bakersfield CA 93301-4639.

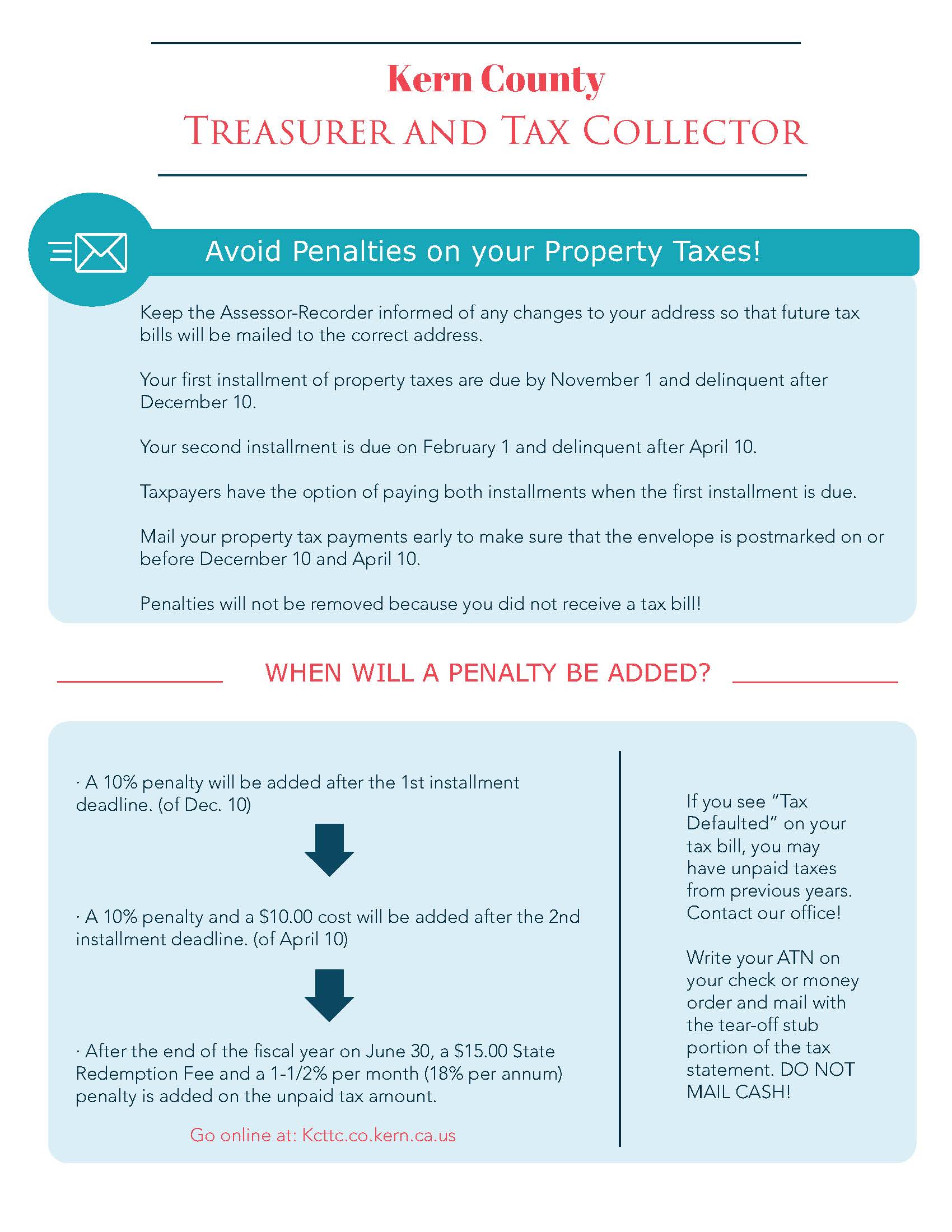

. Exclusions Exemptions Property Tax Relief. Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. In Kern County California a home worth 217100 pays a median property tax of 1746 per year.

They are maintained by. Property Tax Rates Report. Residents of Kern County pay an average of approximately 283 of their.

Property Tax Important Dates. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes.

Enter one or more search terms. Request Copy of Assessment Roll. Application for Tax Penalty Relief.

Click Advanced for more search options. Enter a 10 or 11 digit ATN number with or without the dashes. Enter an 8 or 9 digit APN number with or without the dashes.

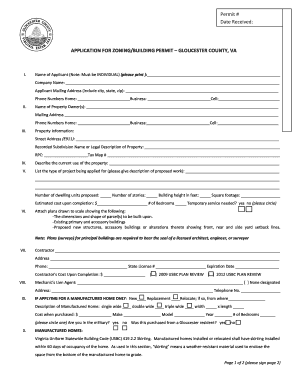

The Kern County Auditor-Controllers Property Tax section is currently in possession of Unclaimed Property Tax Refunds generally resulting from roll corrections or. Opening my small contractor business in 93313 Kern County CA City of Bakersfield Starting ancontractorlooking for my tax certificate in Kern County CA 93313294273. How to Use the Property Search.

Jan 01 2020. Visit Treasurer-Tax Collectors site. Business Personal Property.

Estimated Property Tax Revenue. Application for Tax Relief for Military Personnel. Property Search Options.

Stay Connected with Kern County. Website Usage Policy Auditor - Controller -. Kern County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Kern County California.

Establecer un Plan de Pagos. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Property Taxes - Pay Online.

Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more. The Kern County Auditor-Controllers Property Tax section is currently in possession of Unclaimed Property Tax Refunds generally resulting from roll corrections or. Request For Escape Assessment Installment Plan.

Auditor - Controller - County Clerk.

Kern County Treasurer Delinquent Property Taxes Due June 30 Kern Valley Sun

Study Oil And Gas Industry Contributed More Than 197m To Kern County Last Year

Kern County Taxpayers Association Kern County Taxpayers Association

Lacofd Assists Kern County In Earthquake Response Fire Department

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Solar Charges Make Kern Whole In State Tax Dispute News Bakersfield Com

2022 Best Places To Buy A House In Kern County Ca Niche

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Medi Cal Kern County Ca Department Of Human Services

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

Kern County Transfer On Death Deed Form California Deeds Com

Kern County Treasurer And Tax Collector

Assessor Recorder Kern County Ca

Kern County Board Of Supervisors Approve 2022 2023 Fiscal Budget Kbak

Kern County Ca Property Tax Search And Records Propertyshark